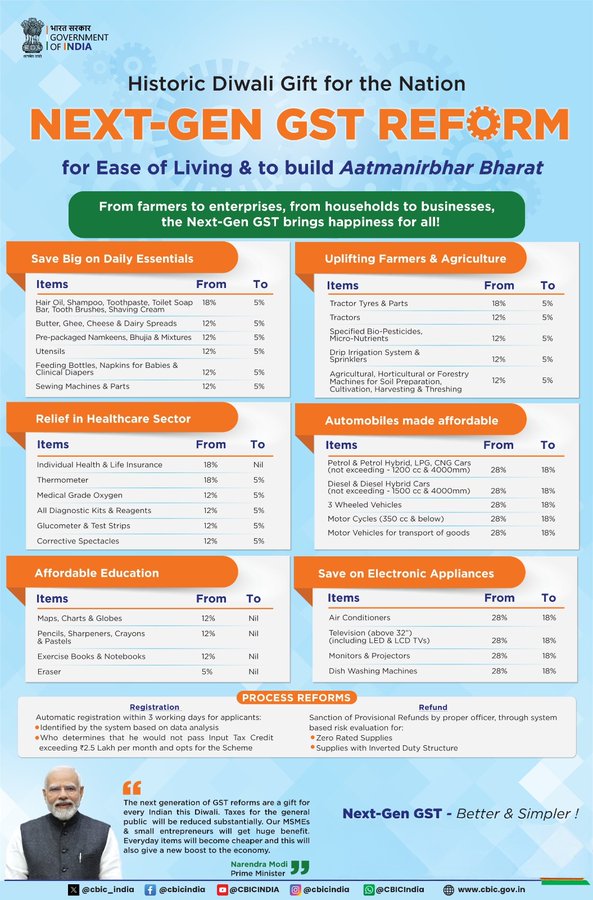

Key Highlights of the Reform

- Simplified Tax Structure

India is moving from a complex four-tier GST system to a two-slab model: 5% and 18%, with an additional 40% slab for luxury and sin goods like high-end cars, tobacco, and certain beverages.

Reuters+1TehelkaThe Hans India - Effective Date:

The reform becomes operative on September 22, 2025, aligning with the start of Navratri.

ReutersTehelkaThe Hans India - Tax Reductions on Essentials:

- Items vital for daily life—like food staples, medicines, toiletries, dairy products—will now attract 5% GST, down from 12% or 18%.

ReutersThe Times of IndiaNewsnation EnglishThe Hans India - Life and health insurance policies are now fully exempt (0% GST)—a notable relief for consumers.

The Times of India+1The Hans India - Salon, gym, and beauty services are also now taxed at 5%.

The Hans India

- Items vital for daily life—like food staples, medicines, toiletries, dairy products—will now attract 5% GST, down from 12% or 18%.

- Support for Farmers:

Agricultural equipment including tractors, tyres, parts, and fertilizers will now attract 5% GST.

ReutersThe Times of IndiaNewsnation English - Electronics & Automobiles:

- Items like air conditioners, TVs, and kitchen appliances will move to 18% GST.

The Hans IndiaNewsnation English - Small cars, motorcycles up to 350 cc, and goods vehicles shift to 18%, improving affordability.

The Hans IndiaNewsnation English

- Items like air conditioners, TVs, and kitchen appliances will move to 18% GST.

- Luxury & Sin Goods – Higher Tax:

Higher-tier items such as mid-size and large cars, SUVs, high-capacity bikes, private aircraft, and sin goods will continue to be taxed at 40%.

TehelkaThe Hans IndiaReuters+1

Implementation Exception

- The rollout of the 40% slab on tobacco and pan masala has been deferred. These products will transition at a later unspecified date.

The Economic Times

Economic Impact & Industry Reactions

- Revenue Impact:

The change could result in a revenue loss estimated at ₹48,000 crore—significant but lower than earlier projections. It may also help reduce inflation by up to 1.1 percentage points.

Reuters+1 - Reform Reception:

The overhaul has been widely welcomed across sectors:- Mahindra Group called it a “transformative” step.

- HDFC ERGO lauded the GST exemption for insurance.

- Kotak Mahindra AMC sees it fostering economic growth and ease of doing business.

Reuters

- Centre-State Balance:

The government affirmed that both the Centre and the states are equal stakeholders in the reform process, aiming to preserve fiscal balance.

The Times of India

At a Glance

| Reform Aspect | Key Detail |

|---|---|

| Rates Introduced | 5%, 18%, and 40% slabs |

| Effective From | September 22, 2025 (Navratri) |

| 0% GST | Life & health insurance |

| Major Reductions | Daily essentials, farmer inputs, electronics, vehicles (small bracket) |

| State Revenue | Some losses expected, but managed with structured rollout |

| Exception Noted | Tobacco & pan masala deferred for now |

Tweeted by Nirmala Sitharaman @nsitharamanoffc

Hon’ble Prime Minister Shri@narendramodi announced the Next-Generation GST Reforms in his Independence Day address from the ramparts of Red Fort. Working on the same principle, the GST Council has approved significant reforms today. These reforms have a multi-sectoral and multi-thematic focus, aimed at ensuring ease of living for all citizens and ease of doing business for all. #NextGenGST